Are you a healthcare facility in The Golden State struggling to find qualified staff? The Employee Retention Credit (ERC) could be a valuable resource to help mitigate some of the costs associated with hiring and retaining talented individuals. This comprehensive guide will walk you through the conditions for meeting the standards for the California Healthcare Staffing ERC Tax Credit, providing you with the knowledge you need to make an informed decision about your tax strategy.

- Explore the specific rules governing this credit for healthcare providers in California.

- Determine if your establishment meets the qualification requirements.

- Gain insight into how to estimate your potential ERC tax credit amount.

- Unveil the process for claiming the credit on your federal and state tax returns.

Don't overlook this opportunity to minimize your tax burden and utilize those funds in strengthening patient care and attracting top talent. Consult our specialists today to optimize read more your ERC eligibility and attain significant financial outcomes.

Unlocking Texas Hospital ERC Refunds in 2024: An Application Guide

Texas hospitals can possibly receive significant tax benefits through the Employee Retention Credit (ERC). In 2024, navigating the application process for ERC refunds can be a complex task. This guide will explain the key steps to ensure your facility successfully claims its eligible ERC refund.

In order to maximize your chances of receiving a full refund, it is important to carefully review the Eligibility for the ERC program. Review recent updates and changes regarding ERC regulations, as they can affect your organization's ability to claim a refund.

Once you have determined your hospital's position, the next phase is to assemble all the necessary documentation. This covers payroll records, financial statements, and any other pertinent documents that support your hospital's claim for the ERC.

After gathering all required paperwork, you can submit your ERC application. Choose a reputable accountant who specializes in ERC claims to assist you through the procedure. They can help you optimize your chances of receiving a swift and favorable refund.

Be patient as the ERC application process can at times take several weeks or even months to finalize. Continue to track on your application with the IRS regularly. Preserve detailed records of all communication with the IRS throughout the process.

Comprehending New York Medical Practice SETC Qualification Criteria

Embarking on a medical career in New York state demands a thorough understanding of the stringent guidelines governing physician licensure. A key aspect of this journey is achieving SETC (State Education and Training Committee) qualification, which validates your education and training satisfy the state's rigorous criteria. The SETC evaluation process encompasses a comprehensive scrutiny of your educational credentials, clinical exposure, and ethical standing.

Successfully navigating this system demands meticulous preparation. Aspiring physicians must carefully compile all required documentation, ensuring accuracy and completeness. Furthermore, a deep understanding of the SETC's precise criteria is crucial. Consulting with experienced mentors can prove invaluable in streamlining this challenging process.

Florida Clinic COVID Tax Credit

Worried about the cost of medical bills? A new program may help. The Florida Clinic COVID Tax Credit allows you to minimize your tax burden. This incredible program offers a great way to save money while also supporting essential healthcare providers.

- Best of all, there are no upfront fees to apply!

- The tax credit is instantly applied to your tax return, so you'll see savings.

- {Don't miss out on this opportunity to save money and support vital healthcare services

Illinois Nursing Home ERC Deadline 2023: Don't Miss Out on Potential Tax Relief

Facing mounting tax pressures? This year, qualified Illinois nursing homes can potentially benefit from a valuable tax credit through the Employee Retention Credit (ERC). The cutoff date for filing claims is fast approaching. Don't miss this opportunity to reduce your tax obligation.

Explore the ERC and determine if your nursing home is eligible. Tools are readily at your disposal to help you navigate this process successfully.

Contact a qualified consultant today to discuss how the ERC can help your nursing home.

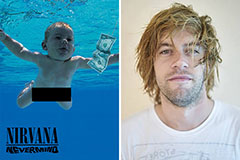

Spencer Elden Then & Now!

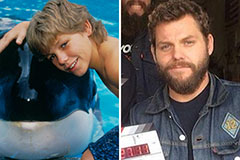

Spencer Elden Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!